Maritime Infrastructure and Trade Week

By John Bradford

Introduction

The People’s Republic of China (PRC) has embarked on a massive investment spree and established a meaningful stake in the control of global maritime infrastructure. These investments include the construction of new ports, the expansion and modernization of cargo handling facilities, the purchase of port management rights, and the establishment of control over the operations of petroleum storage and transshipment depots. Much of the capital is formally sourced from the PRC’s One Belt One Road Initiative, but major investments are also being made directly by state-owned, PLA-linked, and other Chinese enterprises. The scope of control over global maritime infrastructure has become sufficiently large to be of concern. The U.S. Navy’s 2021 Chief of Navy Operations NAVPLAN warns that China is, “extending their infrastructure across the globe to control access to critical waterways.“1

There is growing concern that the PRC has, or could, use its investments to deny infrastructure access to its rivals. To date, PRC enterprises have not overtly denied access to others, but they are creating business models that advantage their partners over their commercial competitors. These advantages could have acute impacts for rivals should colluding PRC enterprises be able to establish themselves as a maritime infrastructure cartel or monopolize a specific market segment. However, PRC investment will have to grow considerably more before either of these options available. In contrast, infrastructure investments are already an important element of the PRC’s growing geo-economic influence over its partners. What deserves greater attention is the implications of PRC investments in global maritime infrastructure by specifically focusing on questions involving the potential denial of competitors’ infrastructure access.

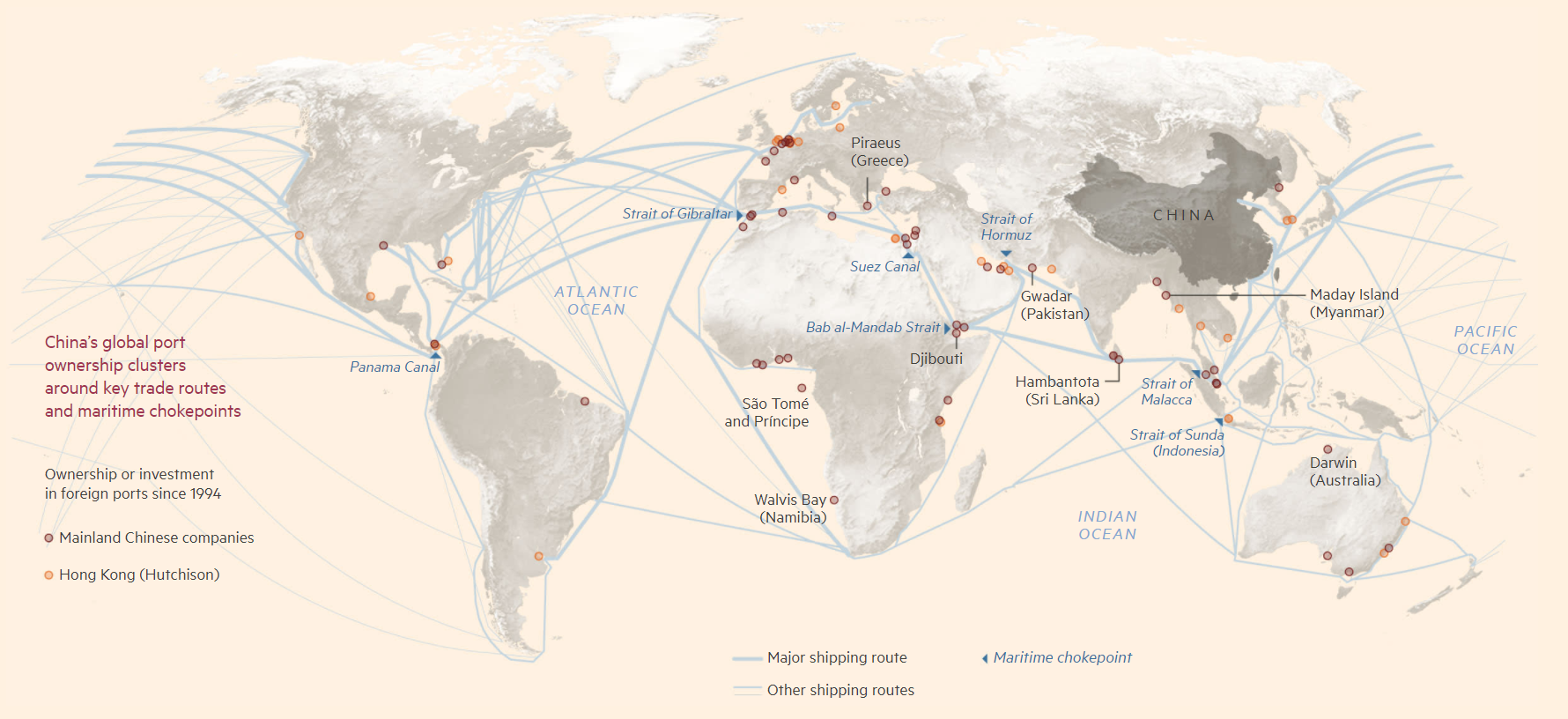

The Scope of PRC Investments in Global Maritime Infrastructure

The infrastructure investments in question are distributed globally and concentrated along the PRC’s main trading routes. The most well-discussed examples along the PRC’s Maritime Silk Road that stretches across the Indian Ocean to Europe include Koh Kong (Cambodia), Melaka (Malaysia), Kyaukpyu (Myanmar), Hambantota (Sri Lanka), Gwadar (Pakistan), Doraleh (Djibouti), and Piraeus (Greece). Looking south and east from China, high-visibility examples include Darwin (Australia); Asua (Solomon Islands); and Luganville (Vanuatu). The chain of PRC maritime infrastructure investments also reaches across the Mediterranean (e.g., Venice, Italy; Tangier, Morocco, and Valencia, Spain), north into Europe (e.g., La Havre, France, Odessa, Ukraine, and Zeebrugge, Belgium), and across the Atlantic (e.g., Freeport, Bahamas and Colon, Panama). Especially noteworthy are the investments around key maritime chokepoints. Colon is at the Caribbean entrance to the Panama Canal. The PRC is also playing a key role in the development of Egypt’s Suez Canal Economic Zone while COSCO Shipping Port company owns a minority share of Suez Canal Terminal.2

The extent of this investment spree is sufficiently large that it is difficult to catalog. Dr. Geoffrey Gresh of the U.S. National Defense University notes that two-thirds of the world’s top 50 container ports have received PRC investments.3 In 2019, Hong Kong-based Hutchinson Port Holdings was the world’s second-largest container port operator, running more than 50 terminals worldwide. Third place COSCO Shipping Ports runs fewer ports but handles more total cargo. China Merchant Ports Holding operates nearly 40 ports in around 20 countries.4

Other PRC firms staking out control over global maritime infrastructure include China Harbor Engineering Company, Qingdao Port International Development, Shanghai International Port Group, the Ningbo-Zhoushan Port Company, Dalian Port Corporation Limited, the Guangxi Beibu Gulf International Port Group, the Shenzhen Yantian Port Group, and the Rizhao Port Group. The AEI/Heritage Foundation China Global Investment Tracker, one of the largest public databases to register this sort of PRC activity, includes over 100 investments in the shipping subsector that total around $2 trillion U.S. dollars. This does not include maritime infrastructure investments filed into the database under categories such as construction, logistics, or energy.5

A great deal of analysis examines the impact of these investments on the naval balance of power. The U.S. government has been clear in its concerns. For example, the U.S. Department of Defense’s 2020 China Military Power Report notes that the PRC concept of Fundamental Domain Resource Sharing dictates that these maritime infrastructure investments are required to provide dual-use functionality and will have important implications “as the PRC seeks to establish a more robust overseas logistics and basing infrastructure to allow the PLA to project and sustain military power.”6 The report specifically states that the PRC has probably already made overtures toward the establishment of such military logistics facilities in Namibia, Vanuatu, and the Solomon Islands, and has likely considered Myanmar, Thailand, Singapore, Indonesia, Pakistan, Sri Lanka, United Arab Emirates, Kenya, Seychelles, Tanzania, and Angola.7 The December 2020 U.S. tri-service maritime strategy similarly warns: “Chinas One Belt One Road initiative is extending its overseas logistics and basing infrastructure that will enable its forces to operate farther from its shores than ever before, including the polar regions, Indian Ocean, and Atlantic Ocean. These projects often leverage predatory lending terms that China exploits to control access to key strategic maritime locations.”8

In comparison to the military aspects, much less reporting and analysis are openly available regarding the commercial implications of the PRC’s global maritime infrastructure investments. There are anecdotes and rumors about PRC-connected port management companies denying access to other nations’ shipping, but this research project was not able to credibly verify these reports. This seems to be because the PRC-related managers are not overtly denying access. Instead, they establish business structures and rules that advantage PRC shipping and thereby force the others to select alternate routing options. These advantages could come in the form of price structures, prioritization for berths, expeditious filing of entry permits and other paperwork, and other measures. These sorts of business advantages would be especially available when the port operator is the same firm as the shipper (e.g., COSCO), but can be assumed to create conditions generally favorable to all PRC operators.

The Strategic Elements of PRC Investments in Global Maritime Infrastructure

The centralized nature of the PRC systems would indicate that, while its various overseas maritime stakeholders do not move in absolute synchronicity, they act with support from the national government and under some degree of strategic direction from the Chinese Communist Party. COSCO, Chinese Merchants, and other large state-owned enterprises have CCP committees embedded into their management boards.9 However, this is not to argue that all investments are part of a centrally-driven master plan. Nor should the sum of the investments be viewed as a monolithic strategy. Often the maritime infrastructure investments are ad hoc investments or independently viable business opportunities that may involve foreign investments moving through the Chinese firms.10

While the linkages between the commercial enterprises, the military, the banking sector, and the state enables Chinese intra-national collusion to become more effective, other global maritime infrastructure stakeholders also take advantage of similarly coordinated cross-sector positions. For example, the vertically integrated Maersk family of Danish businesses includes both the world’s largest shipping company and, with 76 ports in 41 countries, the globe’s fifth-largest port operator.11 Providing a clear example of public-private linkage, the world’s largest port operator, PSA International, is directly tied to the Singapore government.

A growing concern is that continued expansion of PRC investment may enable its vertically integrated enterprises to collude to gain sufficient market share necessary to establish a global maritime supply chain cartel. This could undermine the current advantages of other major players, raise global costs, and create access issues for non-PRC shippers. However, the development of such a market share is far from a foregone conclusion. In fact, a Drewry senior analyst argued that the risk has been disproportionately reported and generally overstated. He points out that, “In the Asia region, Chinese terminal operators accounted for a quarter of all throughput in 2018, but their presence is far more limited in the rest of the world.”12

The degree to which PRC enterprises collude against non-Chinese players is also unclear. The major shipping alliances that enable slot-sharing and vessel-sharing agreements between the largest carriers are not assembled along national lines.13 In August 2020, PRC authorities opened an investigation into whether COSCO (a Chinese company) might be colluding with Maersk, MSC, CMA CGM, Hapag Lloyd, and Evergreen (all non-PRC enterprises) to inflate trans-pacific shipping prices. Similarly, in 2017 the U.S. Department of Justice also raided the biannual Box Club meeting in San Francisco, delivering subpoenas to the assembled CEOs of major international container lines as a part of an anti-trust investigation that involved Chinese and non-Chinese firms. The U.S. closed that investigation in 2019 without prosecutions.14

Regardless of the parties involved, the United States would be particularly disadvantaged if faced with collusion among maritime supply chain participants because of its reliance upon foreign enterprises. The United States no longer has a significant ownership stake in the shipping sector. COSCO carries about 70 times as much cargo as Matson, the largest U.S. carrier.15 The largest U.S. port operator, SSA Marine, has a global reach, operating ports on every continent except Europe, but its total throughput is less than one-third that of China Merchant Ports, one-sixth of Hutchinson or COSCO, and one one-seventh of PSA International.16

PRC government backing is a key enabler of China’s drive for dominance in the maritime infrastructure sector. For example, the opportunity for COSCO to invest in Zeebrugge opened when Maersk’s APM decided to pull out of the relatively small, low-profit port. The concession agreement likely prevented the port’s closure and the retrenchment of its staff. While the agreement was formerly made with COSCO, there is no doubt about the influential role of the PRC government.17 In 2018 the PRC Ambassador to Belgium addressed the bilateral group of government and private industry leaders gathered to conclude the deal by explaining, “The launch of Belt and Road initiative between China and Belgium in 2014 has laid a solid foundation for today’s signing ceremony.”18 In 2019 Zeebrugge enjoyed a growth rate of more than 14 percent thanks to its new role as COSCO’s northern European hub.19

Other PRC investments have been more acrimonious. PRC government loans were essential to enabling COSCO to establish a controlling stake and make investments valued at around $8 billion in Piraeus, Greece.20 The port’s throughput increased significantly because of increased handling capacity, improved connectivity, and the subsequent reshaping of regional trade patterns.21 However, local resentment grew as established workers were fired or put on reduced wages.22

In other cases, the PRC-backed projects have received more problematic resistance. In the early 2000s, the PRC invested hundreds of millions of dollars to finance the expansion of Pakistan’s Gwadar Port. In 2007, PSA International took a 40-year concession to build and operate that port, but immediately faced issues regarding the specific terms of the agreement and the security of the facilities. After only five years, PSA transferred the contract to China Overseas Port Holdings.23 Pakistani Information Minister Qamar Zaman Kaira explained, “PSA could not develop or operate Gwadar ‘as desired.’ The Chinese will make ‘more investment’ to make the port operational.”24 Although Gwadar’s facilities remain under-utilized and unprofitable, it has grown as a focal point for PRC activities in Pakistan. The initiatives include more port construction, the inauguration of a Sino-Pakistan economic free zone (from with China received 85 percent of the profits), and $800 million in Chinese pledges for projects to support the local population such as the construction of a school, expansion of a hospital, and improvement of the public water treatment system.25 Violent separatists began targeting Chinese workers around the port as early as 2004 and the violence is intensifying. The Balochistan Liberation Army (BLA) attacked the Chinese consulate in Karachi in 2018 and in 2019 three BLA members stormed Gwadar’s Pearl Continental Hotel, killing five people.26 In the wake of these incidents, the PRC is doubling down on its presence by financing the fencing off of over 60km2 around the seaport.27

The PRC’s commitment to Gwadar demonstrates that the maritime infrastructure investments are driven by more than a simple desire to expand the profitability of China’s international trade. Indeed, while Gwadar may someday become a profitable commercial hub, it seems likely to bring even greater benefit to the PRC as a naval staging area or as an economic anchor holding Pakistan in the PRC’s geopolitical orbit. In fact, Gwadar and other investments are specifically designed to carry geo-economic weight.

A useful academic definition of geo-economics is, “the use of economic instruments to promote and defend national interests and to produce beneficial geopolitical results; and the effect to other nations’ economic actions on a country’s geopolitical goals.”28 Maritime infrastructure investments are particularly powerful geo-economic instruments for several reasons. First, their scale is such that they convey a lot of capital and that equates to a lot of immediate influence, especially with the investor that can control the rate of disbursement.29 Furthermore, the investments are such that they create recurrent sources of wealth in the form of on-sight labor requirements, maintenance requirements, and international trade. However, to a greater extent than other infrastructure (for example, interior roads or schools), maritime infrastructure binds the port community to China. Once the investments are complete, the new or enlarged facilities are reliant on trade to stay active. In extreme cases, the ‘Port-Park-City’ model is employed. Development of the port is followed by a Chinese-funded/managed industrial park, and then the emergence proxy Chinese city.30 However, the investment does not bind China by reciprocal dependency; if the port state were to deny access to PRC shipping, the PRC can rely on its diversified portfolio to reroute shipping via other infrastructure.

The Keys to Controlling Port Access

There is no clear case where the PRC has overtly exercised its geo-economic power to deny competitors port access. However, such a situation is far from unimaginable. The PRC has overtly used its geo-economic leverage, much of which is tied to its investments in Piraeus to persuade Greece to weaken EU statements denounce the PRC’s human rights effort.31 There are also unconfirmed rumors that the PRC has quietly used its influence to arranged for denial of access to Japanese ships.32 In contrast, U.S. Navy ships continue to call in Piraeus.33 While overt action to prevent access would incur costs such as political backlash and increased insurance costs, the PRC will likely expect those costs to diminish as its relative power expands.34 Therefore, should the PRC be faced with a crisis or the appropriate pressures, it would not be surprising if it sought to exercise this option.

The concept of using infrastructure investments to create international leverage is not new. One study explained that “China is updating and exercising tactics used by Western powers during the nineteenth and twentieth centuries.”35 More specifically, the denial of access to maritime infrastructure to achieve political aims is well-established in international relations. These tools have been used by states and the international community in recent years.

United Nations Security Council (UNSC) Resolutions against North Korea currently restrict that nation’s access to global maritime infrastructure. In October 2017, the UNSC took the unprecedented action of banning four ships accused of smuggling North Korean coal from entering any port. In April 2018, the Wise Honest, one of North Korea’s largest cargo ships, was detained in Indonesia and then seized by the United States. When a local Indonesian court allowed the cargo from the Wise Honest to be released, it was loaded onto the ship Dong Thanh operated by Qingdao Global Shipping. Because of its illicit cargo and the use of associated falsified documents, Dong Thanh was denied entry to Malaysia before it called into Vietnam.36 U.S. government cited authorities found in domestic legislation when seizing M/T Courageous, another vessel smuggling oil to North Korea, that has been held in port by Cambodian officials since March 2020.37

The clearest example of a state currently unilaterally acting to prevent another state from accessing maritime infrastructure is recent U.S. sanctions on Iran. The sanctions have been enacted through domestic U.S. legislation and have the stated aim of denying Iran the financial resources to support terrorist organizations and other armed factions, or to further its nuclear and weapons of mass destruction programs. These sanctions do not require other countries to impound any Iranian ships or other cargo, but in September 2019, guidance was updated to state that port bunkering services for Iranian oil shipments could subject firms and individuals to U.S. sanctions.38 Unilateral U.S. sanctions have also created challenges for Iranian shippers to obtain insurance, since a New York-based pool of insurance organizations, the International Group of P&I Clubs, dominates the shipping insurance industry.39

Conclusion

The PRC’s rapidly expanding network of global maritime infrastructure investments is already delivering meaningful commercial advantages. Further expansion of this network could bring it sufficient additional leverage that it can impede rivals’ ability to freely operate. Active collusion between PRC enterprises would make their power particularly problematic. However, the market still appears sufficiently competitive to prevent this from becoming an immediate concern. In the near term, a larger worry is that these maritime infrastructure investments will provide the PRC with sharp geo-economic power to influence the behavior of partner nations. While using that power to deny access to a competitor would come with certain costs, it seems completely plausible that, given the proper incentives, the PRC could consider pushing a port state to take such an action.

John Bradford is a Senior Fellow in the Maritime Security Programme at the S Rajaratnam School of International Studies and the Executive Director of the Yokosuka Council on Asia Pacific Studies. Prior to entering the research sector, he spent 23 years as a U.S. Navy Surface Warfare Officer focused on Indo-Pacific maritime dynamics.

References

[1] M. Gilday, CNO NAVPLAN, Jan 2021 <https://www.navy.mil/Press-Office/Press-Releases/display-pressreleases/Article/2467465/cno-releases-navigation-plan-2021/#.YIERS3QoZiU.link>

[2] Claudo Ferrai and Alessio Tei, “Effect of BRI strategy on Mediterranean shipping transport,” Journal of Shipping and Trade, 5:14, 2020, p. 12 and Jevans Nyabiage, “Why China is banking on Suez and plans for a new Egyptian capital,” South China Morning Post, 10 Apr 2021 <https://www.scmp.com/news/china/diplomacy/article/3129000/why-china-banking-suez-and-plans-new-egyptian-capital>

[3] Geoffrey Gresh, To Rule Eurasia’s Waves: The New Great Power Competition at Sea, London: Yale University Press, 2020, p. 11

[4] “Top 10 Box Port Operators 2019,” Lloyd List, 01 Dec 2019 <https://lloydslist.maritimeintelligence.informa.com/LL1130163/Top-10-box-port-operators-2019> and Gresh, p. 65

[5] China Global Investment Tracker <https://www.aei.org/china-global-investment-tracker/>

[6] U.S. Department of Defense, China Military Power Report 2020, p. 19.

[7] U.S. Department of Defense, p. 120.

[8] U.S. Department of the Navy, Advantage at Sea, p. 4.

[9] Charles Lyons Jones and Raphael Veit, Leaping Across the Ocean: The port operators behind China’s naval expansion, Australian Strategic Policy Institute, pp. 4, 8, 14 and 25.

[10] Ferrai and Tei, p. 7.

[11] “Top 10 Box Port Operators 2019;” Jones and Veit, p. 10; and “Biggest shipping companies: Top ten by TEU capacity,” Ship Technology <https://www.ship-technology.com/features/the-ten-biggest-shipping-companies-in-2020/>

[12] James Baker, “Chinese ownership of foreign ports concerns are ‘overstated’, Lloyds List, 03 Dec 2019 <https://lloydslist.maritimeintelligence.informa.com/LL1130247/Chinese-ownership-of-foreign-ports-concerns-are-overstated>

[13] “Newly Formed Ocean Alliance has Huge Impact on Container Shipping,” Atlas Logistics Network <https://atlas-network.com/newly-formed-ocean-alliance-has-huge-impact-on-container-shipping/> and Ocean Alliance, JOC.com <https://www.joc.com/maritime-news/container-lines/ocean-alliance>

[14] Costas Paris, “U.S. Drops Container Shipping Cartel Investigation Without Charges, Wall Street Journal, 26 Feb 2019 <https://www.wsj.com/articles/u-s-drops-container-shipping-cartel-investigation-without-charges-11551200327>

[15] Matt Woodley, “Top 30 International Shipping Companies,” MoverFocus.com, 27 Sept 2019 <https://moverfocus.com/shipping-companies/>

[16] “Top 10 Box Port Operators 2019.”

[17] Joanna Kakissis, “Chinese Firms Now Hold Stakes in Over A Dozen European Ports,” National Public Radio, 9 Oct 2018 <https://www.npr.org/2018/10/09/642587456/chinese-firms-now-hold-stakes-in-over-a-dozen-european-ports>

[18] “COSCO Shipping Ports Signs Concession Agreement with Port of Zeebrugge Reach MOU with CMA for Strategic Partnership,” press release, COSCO Shipping, 23 Jan 2018 <https://ports.coscoshipping.com/en/Media/PressReleases/content.php?id=20180123>

[19] “Port of Zeebrugge 2019:14.2% Growth” Port of Zeebrugge, 1 July 2020 <https://portofzeebrugge.be/en/news-events/port-zeebrugge-2019-142-growth> and Gavin van Marie, “Cosco Launces Move to Make Zeebrugge its North European Hub,” 01 May 2010 <https://theloadstar.com/cosco-launches-bid-to-make-zeebrugge-its-north-european-hub/>

[20] J Jonathan Hillman, “Influence and Infrastructure: The Strategic Stakes of foreign Projects,” CSIS Reconnecting Asia Project, Jan 2019, p. 9; Jones and Veit, p. 13; and Ferrai and Tei, p. 11.

[21] Ferrai and Tei, p.2.

[22] Hillman, p. 19.

[23] Gresh, p. 122.

[24] “Pakistan OKs PSA International’s Exit from Gwadar,” 01 Feb 2012, <https://www.joc.com/port-news/terminal-operators/psa-international/pakistan-oks-psa-internationals-exit-gwadar-port_20130201.html>

[25] Gresh, p. 123.

[26] “Pakistan Attack: Gunmen Storm Five-star Hotel in Balochistan,” 12 May 2019, <https://www.bbc.com/news/world-asia-48238759>

[27] “’Chinese Colony; in CPEC-Hub Gwadar Draw the Ire of People in Balochistan, Pakistan,” The EurAsian Times, 15 Dec 2020 <https://eurasiantimes.com/chinese-colony-in-cpec-hub-gwadar-draws-the-ire-of-people-in-balochistan-pakistan/>

[28] Robert Blackwill and Jennifer Marris, War by Other Means: Geoeconomic and Statecraft. Cambridge, Massachusetts: Harvard University Press, 2016, p.6.

[29] Hillman, p. 4.

[30] Logan Pauley and Hamza Shad, “Gwadar: Emerging Port City of Chinese Colony,” The Diplomat, 5 Oct 2018, <https://thediplomat.com/2018/10/gwadar-emerging-port-city-or-chinese-colony/>

[31] Jones and Veit, p. 21

[32] Gresh, pp. 66-7.

[33] USS Mitscher Public Affairs, “USS Mitscher Departs Piraeus, Greece,” 17 Apr 2019, <https://www.c6f.navy.mil/Press-Room/News/Article/1816242/uss-mitscher-departs-piraeus-greece/>

[34] Jones and Veit, p. 10.

[35] Hillman, p. 2.

[36] President United Nations Security Council, Note S/2019/691, 30 Aug 2019.

[37] US Attorney’s Office, Southern District of New York, “U.S. Government Seized Oil Tanker Used to Violate U.S. and U.N. Sanctions Against North Korea,” 23 Apr 2021, <https://www.justice.gov/usao-sdny/pr/us-government-seizes-oil-tanker-used-violate-us-and-un-sanctions-against-north-korea>

[38] Kenneth Katzman, “Iran Sanctions,” Congressional Research Service, 18 Nov 2020, pp. 10-11.

[39] Katzman, p. 8.

Featured Image: Chinese trucks carrying trade goods are pictured parked at the Gwadar port, Pakistan. (Photo via AAMIR QURESHI/AFP/Getty Images)